A reputable consumer lending company with a nationwide footprint, offering personalized financial solutions and loans for individuals with varying credit scores. The client needed a powerful custom platform to handle the full lifecycle of their loan management processes.

Automation of loan workflows

Real-time reporting types

Faster loan processing

Reduction in manual collection

The Chalange

The client was operating on an off-the-shelf loan management system that lacked flexibility, failed to integrate with mission-critical tools, and didn’t meet their operational demands. They needed a secure, custom-built solution that aligned with federal and state compliance requirements, automated every step of the lending process, and smoothly integrated with credit bureaus and third-party services.

What Did

Enhaims Do?

We provided a dedicated full-stack team, including senior architects, developers, analysts, QA specialists, and DevOps engineers. First, we elicited detailed business and technical requirements. Then, we designed a scalable architecture and built a full-featured loan management system from the ground up.

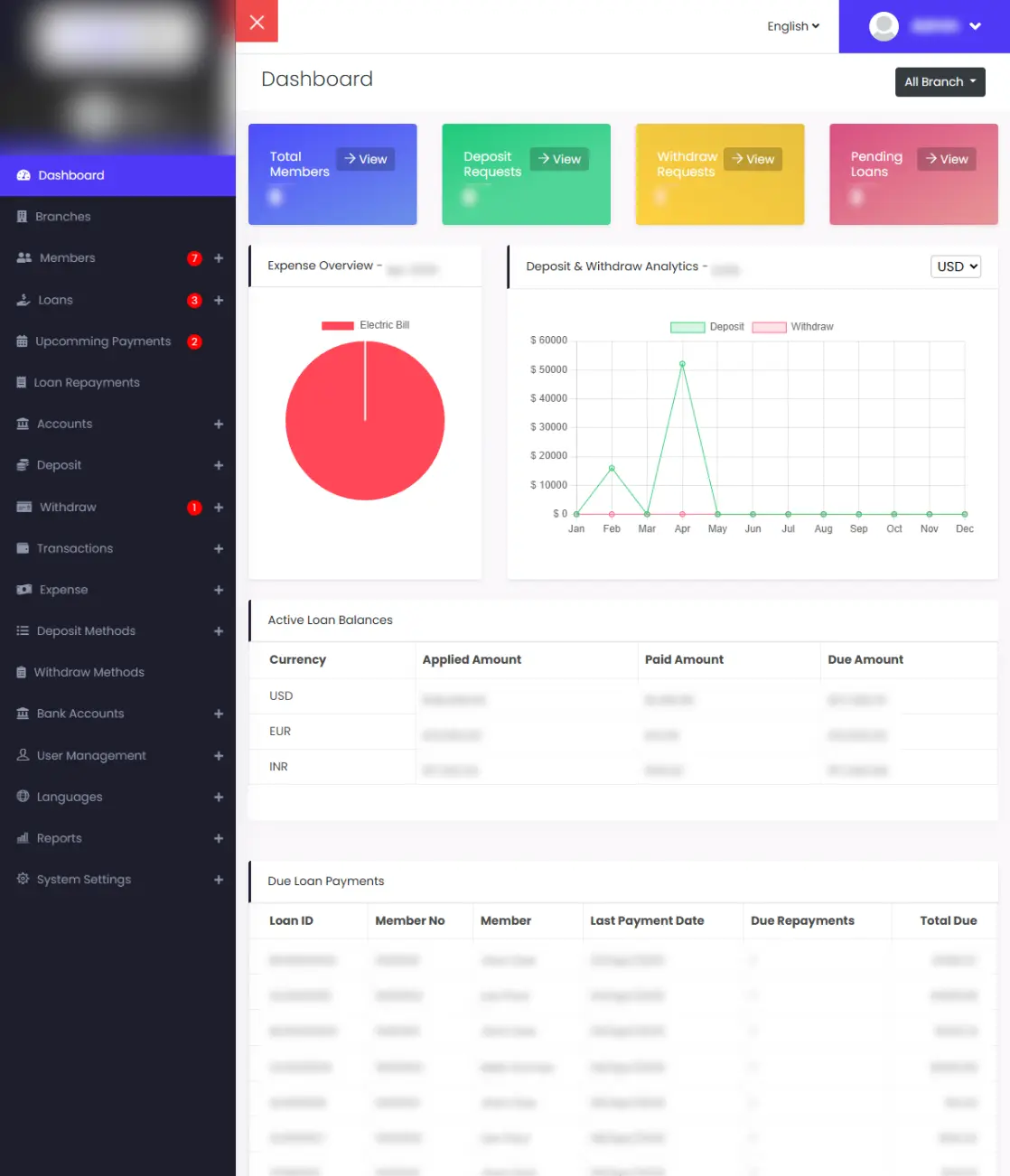

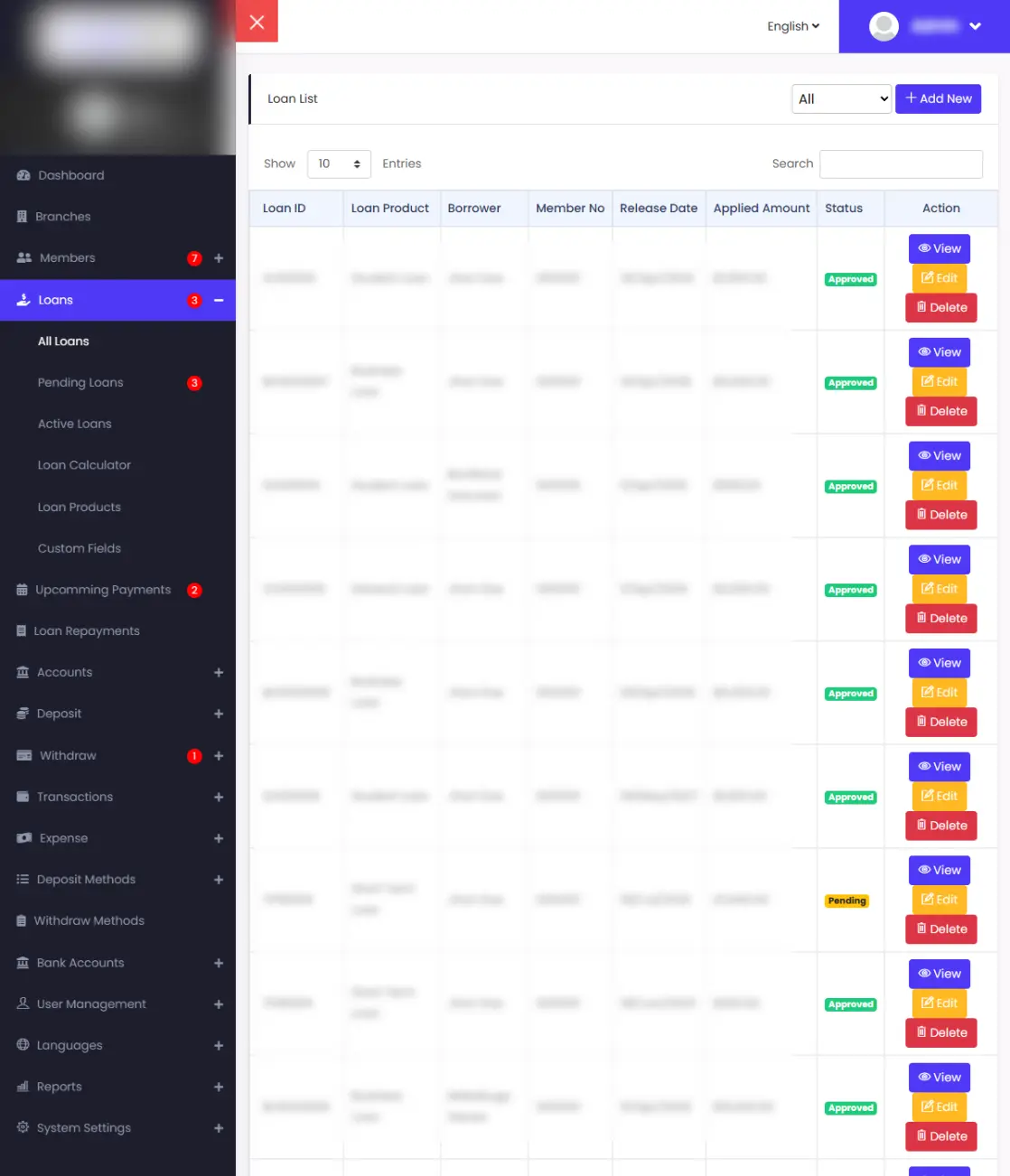

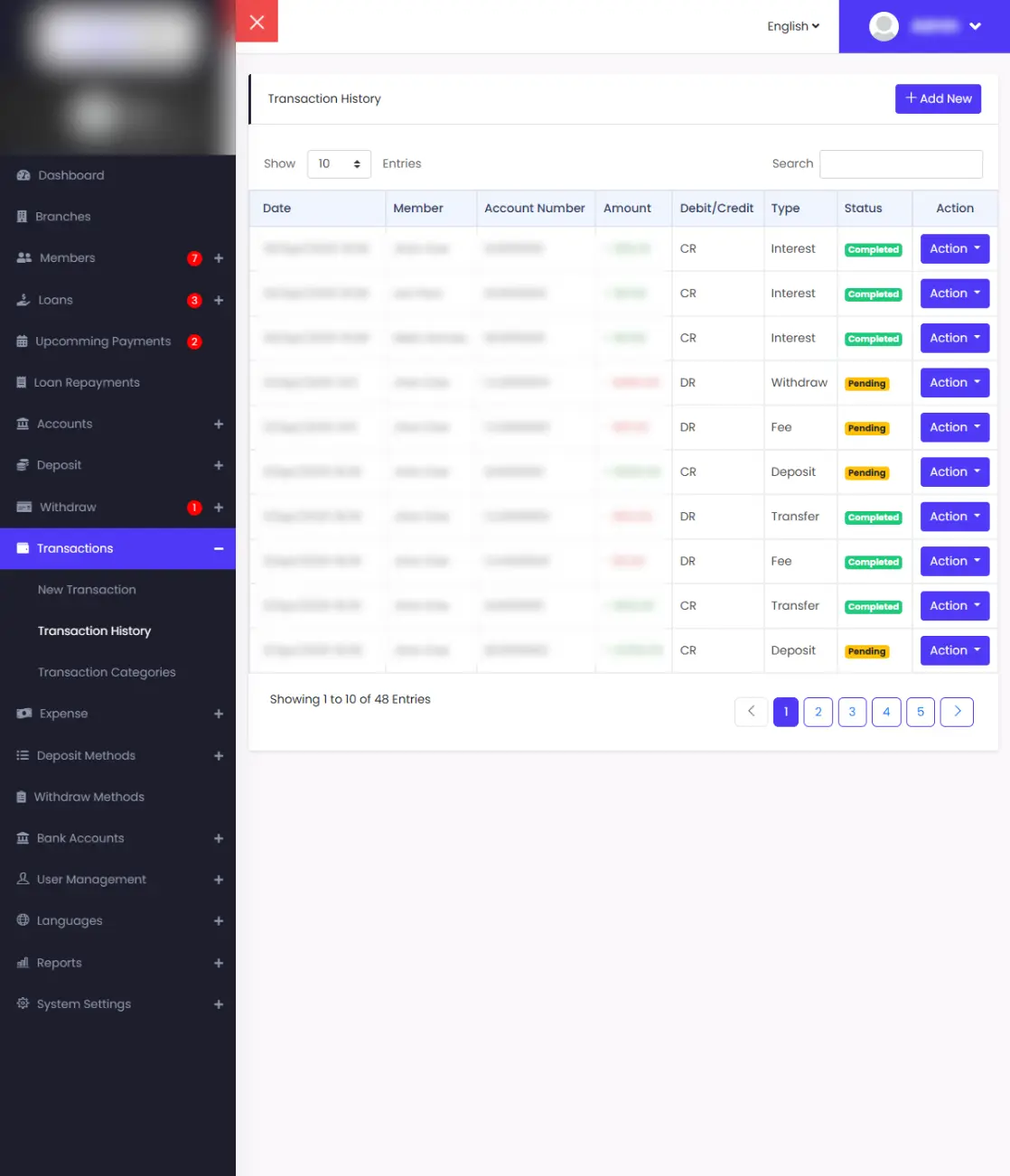

The platform supports everything from application intake to real-time dashboard analytics, automated document generation, credit checks, debt collection, and over 50+ types of reports.

Seamless integrations were achieved with the client’s software ecosystem, three major US credit bureaus, and a national SMS platform. We also ensured a UI/UX transition that was intuitive and familiar, helping onboard users effortlessly.

Our DevOps pipeline accelerated delivery, while containerization ensured high availability and easy scalability.

The Results

- Complete transition from outdated legacy system

- End-to-end automation of lending, credit scoring, and collections

- Real-time compliance-aligned documentation

- Dashboards for executives and office-level views

- Smooth user adoption and high user satisfaction

- Infrastructure ready for scale across all 50+ locations